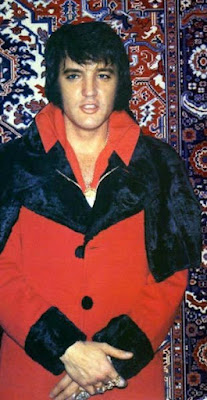

Quando Elvis percebeu que estava perdendo o controle das coisas,aguardou ate o tour que fazia terminar e foi assinar o seu testamento,preparado por seu advogado,em Memphis.

O documento continha 13 páginas e foi levado ate Graceland para ele assinar.Era o dia 03 de Março,e ele assinou,na presença de tres testemunhas:Ginger,Charlie Hodge e uma prima de Elvis.

Foram nomeados tres beneficiarios:sua filha,seu pai e sua avó.O administrador seria Vernon,com a responsabilidade deprovidenciar assistencia financeira aos demais parentes,no caso de alguma emergencia.Essa generosidade se encerraria apos a morte de Vernon.

Observa-se que ninguem mais foi mencionado:nem Ginger,nem Priscilla,nem um empregado,amigo ou Instituição Filantrópica....

Abaixo vejam a integra do documento:

Last Will And Testament Of Elvis A. Presley, Deceased

Filed August 22, 1977

Last Will And Testament of Elvis Presley

I, Elvis A. Presley, a resident and citizen of Shelby County,

Tennessee, being of sound mind and disposing memory, do hereby

make, publish and declare this instrument to be my last will and

testament, hereby revoking any and all wills and codicils by me

at any time heretofore made.

Filed August 22, 1977

Last Will And Testament of Elvis Presley

I, Elvis A. Presley, a resident and citizen of Shelby County,

Tennessee, being of sound mind and disposing memory, do hereby

make, publish and declare this instrument to be my last will and

testament, hereby revoking any and all wills and codicils by me

at any time heretofore made.

Item I

Debts, Expenses and TaxesI direct my Executor, hereinafter named, to pay all of my

matured debts and my funeral expenses, as well as the costs and

expenses of the administration of my estate, as soon after my

death as practicable. I further direct that all estate,

inheritance, transfer and succession taxes which are payable by

reason under this will, be paid out of my residuary estate; and

I hereby waive on behalf of my estate any right to recover from

any person any part of such taxes so paid. My Executor, in his

sole discretion, may pay from my domiciliary estate all or any

portion of the costs of ancillary administration and similar

proceedings in other jurisdictions.

Item II

Instruction Concerning Personal Property: Enjoyment in SpecieI anticipate that included as a part of my property and estate

at the time of my death will be tangible personal property of

various kinds, characters and values, including trophies and

other items accumulated by me during my professional career. I

hereby specifically instruct all concerned that my Executor,

herein appointed, shall have complete freedom and discretion as

to disposal of any and all such property so long as he shall act

in good faith and in the best interest of my estate and my

beneficiaries, and his discretion so exercised shall not be

subject to question by anyone whomsoever.

I hereby expressly authorize my Executor and my Trustee,

respectively and successively, to permit any beneficiary of any

and all trusts created hereunder to enjoy in specie the use or

benefit of any household goods, chattels, or other tangible

personal property (exclusive of choses in action, cash, stocks, bonds or other securities) which either my Executor or my

Trustees may receive in kind, and my Executor and my Trustees

shall not be liable for any consumption, damage, injury to or

loss of any tangible property so used, nor shall the

beneficiaries of any trusts hereunder or their executors of

administrators be liable for any consumption, damage, injury to

or loss of any tangible personal property so used.

Item III

Real EstateIf I am the owner of any real estate at the time of my death, I

instruct and empower my Executor and my Trustee (as the case may

be) to hold such real estate for investment, or to sell same, or

any portion therof, as my Executor or my Trustee (as the case

may be) shall in his sole judgment determine to be for the best

interest of my estate and the beneficiaries thereof.

Item IV

Residuary TrustAfter payment of all debts, expenses and taxes as directed under

Item I hereof, I give, devise, and bequeath all the rest,

residue, and remainder of my estate, including all lapsed

legacies and devices, and any property over which I have a power

of appointment, to my Trustee, hereinafter named, in trust for

the following purposes:

(a) The Trustees is directed to take, hold, manage, invest and

reinvent the corpus of the trust and to collect the income

therefrom in accordance with the rights, powers, duties,

authority and discretion hereinafter set forth. The Trustee is

directed to pay all the expenses, taxes and costs incurred in

the management of the trust estate out of the income thereof.

(b) After payment of all expenses, taxes and costs incurred in

the management of the expenses, taxes and costs incurred in the

management of the trust estate, the Trustee is authorizes to

accumulate the net income or to pay or apply so much of the net

income and such portion of the principal at any time and from

time to time to time for health, education, support, comfortable

maintenance and welfare of: (1) My daughter, Lisa

Marie Presley, and any other lawful issue I might have, (2) my

grandmother, Minnie Mae Presley, (3) my father, Vernon E.

Presley, and (4) such other relatives of mine living at the time

of my death who in the absolute discretion of my Trustees are in

need of emergency assistance for any of the above mentioned

purposes and the Trustee is able to make such distribution

without affecting the ability of the trust to meet the present

needs of the first three numbered categories of beneficiaries

herein mentioned or to meet the reasonably expected future needs

of the first three classes of beneficiaries herein mentioned.

Any decision of the Trustee as to whether or not distribution,

to any of the persons described hereunder shall be final and

conclusive and not subject to question by any legatee or

beneficiary hereunder.

reinvent the corpus of the trust and to collect the income

therefrom in accordance with the rights, powers, duties,

authority and discretion hereinafter set forth. The Trustee is

directed to pay all the expenses, taxes and costs incurred in

the management of the trust estate out of the income thereof.

(b) After payment of all expenses, taxes and costs incurred in

the management of the expenses, taxes and costs incurred in the

management of the trust estate, the Trustee is authorizes to

accumulate the net income or to pay or apply so much of the net

income and such portion of the principal at any time and from

time to time to time for health, education, support, comfortable

maintenance and welfare of: (1) My daughter, Lisa

Marie Presley, and any other lawful issue I might have, (2) my

grandmother, Minnie Mae Presley, (3) my father, Vernon E.

Presley, and (4) such other relatives of mine living at the time

of my death who in the absolute discretion of my Trustees are in

need of emergency assistance for any of the above mentioned

purposes and the Trustee is able to make such distribution

without affecting the ability of the trust to meet the present

needs of the first three numbered categories of beneficiaries

herein mentioned or to meet the reasonably expected future needs

of the first three classes of beneficiaries herein mentioned.

Any decision of the Trustee as to whether or not distribution,

to any of the persons described hereunder shall be final and

conclusive and not subject to question by any legatee or

beneficiary hereunder.

(f) If any of my children for whose benefit a trust has been

created hereunder should die before attaining the age of twenty-

five (25) years, then the trust created for such a child shall

terminate on his death, and all remaining assets then contained

in said trust shall be distributed outright and free of further

trust and in equal shares to the surviving issue of such

deceased child but subject to the provisions of Item V herein;

but if there be no such surviving issue , then to the brothers

and sisters of such deceased child in equal shares, the issue of

any other deceased child being entitled collectively to their

deceased parent's share. Nevertheless, if any distribution

otherwise becomes payable outright and free of trust under the

provisions of this paragraph (f) of the Item IV of my will to a

beneficiary for whom the Trustee is then administering a trust

for the benefit of such beneficiary under provisions of this

last will and testament, such distribution shall not be paid

outright to such beneficiary but shall be added to and become a

part of the trust so being administered for such beneficiary by

the Trustee.

created hereunder should die before attaining the age of twenty-

five (25) years, then the trust created for such a child shall

terminate on his death, and all remaining assets then contained

in said trust shall be distributed outright and free of further

trust and in equal shares to the surviving issue of such

deceased child but subject to the provisions of Item V herein;

but if there be no such surviving issue , then to the brothers

and sisters of such deceased child in equal shares, the issue of

any other deceased child being entitled collectively to their

deceased parent's share. Nevertheless, if any distribution

otherwise becomes payable outright and free of trust under the

provisions of this paragraph (f) of the Item IV of my will to a

beneficiary for whom the Trustee is then administering a trust

for the benefit of such beneficiary under provisions of this

last will and testament, such distribution shall not be paid

outright to such beneficiary but shall be added to and become a

part of the trust so being administered for such beneficiary by

the Trustee.

Item V

Distribution to Minor ChildrenIf any share of corpus of any trust established under this will

become distributable outright and free of trust to any

beneficiary before said beneficiary has attained the age of

eighteen (18) years, then said share shall immediately vest in

said beneficiary, but the Trustee shall retain possession of

such share during the period in which such beneficiary is under

the age of eighteen (18) years, and, in the meantime, shall use

and expend so much of the income and principal for the care,

support, and education of such beneficiary, and any income not

so expended with respect to each share so retained all the power

and discretion had with respect to such trust generally.

Item VI

Alternate DistributeesIn the event that all of my descendants should be deceased at

any time prior to the time for the termination of the trusts

provided for herein, then in such event all of my estate and all

the assets of every trust to be created hereunder (as the case

may be) shall then distributed outright in equal shares to my

heirs at law per stripes.

Item VII

Unenforceable ProvisionsIf any provisions of this will are unenforceable, the remaining

provisions shall, nevertheless, be carried into effect.

Item VIII

Life InsuranceIf my estate is the beneficiary of any life insurance on my

life at the time of my death, I direct that the proceeds

therefrom will be used by my Executor in payment of the debts ,

expenses and taxes listed in Item I of this will, to the extent

deemed advisable by the Executor. All such proceeds not so used

are to be used by my Executor for the purpose of satisfying the

devises and bequests contained in Item IV herein.

Item IX

Spendthrift ProvisionI direct that the interest of any beneficiary in principal or

income of any trust created hereunder shall not be subject to

claims of creditors or others, nor to legal process, and may not

be voluntarily or involuntarily alienated or encumbered except as

herein provided. Any bequests contained herein for any female

shall be for her sole and separate use, free from the debts,

contracts and control of any husband she may ever have.

Item XI

Executor and TrusteeI appoint as executor of this, my last will and testament, and

as Trustee of every trust required to be created hereunder, my

said father.

I hereby direct that my said father shall be entitled by his

last will ant testament, duly probated, to appoint a successor

Executor of my estate, as well as a successor Trustee or

successor Trustees of all the trusts to be created under my last

will and testament.

If, for any reason, my said father be unable to serve or to

continue to serve as Executor and/or as Trustee, or if he be

deceased and shall not have appointed a successor Executor or

Trustee, by virtue of his last will and testament as stated

-above, then I appoint National Bank of Commerce, Memphis,

Tennessee, or its successor or the institution with which it may

merge, as successor Executor and/or as successor Trustee of all

trusts required to be established hereunder.

None of the appointees named hereunder,including any appointment

made by virtue of the last will and testament of my said father,

shall be required to furnish any bond or security for

performance of the respective fiduciary duties required

hereunder, notwithstanding any rule of law to the contrary.

Item XII

Powers, Duties, Privileges and Immunities of the TrusteeExcept as otherwise stated expressly to the contrary herein, I

give and grant to the said Trustee (and to the duly appointed

successor Trustee when acting as such) the power to do

everything he deems advisable with respect to the administration

of each trust required to be established under this, my last

will and Testament, even though such powers would not be

authorized or appropriate for the Trustee under statutory or

other rules of law. By way of illustration and not in

limitation of the generality of the foregoing grant of power and

authority of the Trustee, I give and grant to him plenary power

as follows:

a) To exercise all those powers authorized to fiduciaries under

the provisions of the Tennessee Code Annotated, Sections 35-616

to 35-618, inclusive, including any amendments thereto in effect

at the time of my death, and the same are expressly referred to

and incorporated herein by reference.

the provisions of the Tennessee Code Annotated, Sections 35-616

to 35-618, inclusive, including any amendments thereto in effect

at the time of my death, and the same are expressly referred to

and incorporated herein by reference.

(b) Plenary power is granted to the Trustee, not only to relieve

him from seeking judicial instruction, but to the extent that

the Trustee deems it to be prudent, to encourage determinations

freely to be made in favor of persons who are the current income

beneficiaries. In such instances the rights of all subsequent

beneficiaries are subordinate, and the Trustee shall not be

answerable to any subsequent beneficiary for anything done or

omitted in favor of a current income beneficiary may compel any

such favorable or preferential treatment. Without in anywise

minimizing or impairing the scope of this declaration of intent,

it includes investment policy, exercise of discretionary power

to pay or apply principal and income, and determination

principal and income questions;

him from seeking judicial instruction, but to the extent that

the Trustee deems it to be prudent, to encourage determinations

freely to be made in favor of persons who are the current income

beneficiaries. In such instances the rights of all subsequent

beneficiaries are subordinate, and the Trustee shall not be

answerable to any subsequent beneficiary for anything done or

omitted in favor of a current income beneficiary may compel any

such favorable or preferential treatment. Without in anywise

minimizing or impairing the scope of this declaration of intent,

it includes investment policy, exercise of discretionary power

to pay or apply principal and income, and determination

principal and income questions;

(c) It shall be lawful for the Trustee to apply any sum that is

payable to or for the benefit of a minor (or any other person

who in the Judgment of the Trustee, is incapable of making

proper disposition thereof) by payments in discharge of the

costs and expenses of educating, maintaining and supporting said

beneficiary, or to make payment to anyone with whom said

beneficiary resides or who has the care or custody of the

beneficiary, temporarily or permanently, all without

intervention of any guardian or like fiduciary. The receipt of

anyone to whom payment is so authorized to be made shall be a

complete discharge of the Trustees without obligation on his

part to see to the further application hereto, and without

regard to other resource that the beneficiary may have, or the

duty of any other person to support the beneficiary;

payable to or for the benefit of a minor (or any other person

who in the Judgment of the Trustee, is incapable of making

proper disposition thereof) by payments in discharge of the

costs and expenses of educating, maintaining and supporting said

beneficiary, or to make payment to anyone with whom said

beneficiary resides or who has the care or custody of the

beneficiary, temporarily or permanently, all without

intervention of any guardian or like fiduciary. The receipt of

anyone to whom payment is so authorized to be made shall be a

complete discharge of the Trustees without obligation on his

part to see to the further application hereto, and without

regard to other resource that the beneficiary may have, or the

duty of any other person to support the beneficiary;

d) In Dealing with the Trustee, no grantee, pledge, vendee,

mortgage, lessee or other transference of the trust properties,

or any part therof, shall be bound to inquire with respect to

the purpose or necessity of any such disposition or to see to

the application of any consideration therefore paid to the

Trustee.

(a) If at any time the Trustee shall have reasonable doubt as to

his power, authority or duty in the administration of any trust

herein created, it shall be lawful for the Trustee to obtain the

advice and counsel of reputable legal counsel without resorting

to the courts for instructions; and the Trustee shall be fully

absolved from all liability and damage or detriment to the

various trust estates of any beneficiary thereunder by reason of

anything done, suffered or omitted pursuant to advice of said

counsel given and obtained in good faith, provided that nothing

contained herein shall be construed to prohibit or prevent the

Trustee in all proper cases from applying to a court of

competent jurisdiction for instructions in the administration

of the trust assets in lieu of obtaining advice of counsel.

mortgage, lessee or other transference of the trust properties,

or any part therof, shall be bound to inquire with respect to

the purpose or necessity of any such disposition or to see to

the application of any consideration therefore paid to the

Trustee.

Item XIII

Concerning the Trustee and the Executor(a) If at any time the Trustee shall have reasonable doubt as to

his power, authority or duty in the administration of any trust

herein created, it shall be lawful for the Trustee to obtain the

advice and counsel of reputable legal counsel without resorting

to the courts for instructions; and the Trustee shall be fully

absolved from all liability and damage or detriment to the

various trust estates of any beneficiary thereunder by reason of

anything done, suffered or omitted pursuant to advice of said

counsel given and obtained in good faith, provided that nothing

contained herein shall be construed to prohibit or prevent the

Trustee in all proper cases from applying to a court of

competent jurisdiction for instructions in the administration

of the trust assets in lieu of obtaining advice of counsel.

(b) In managing, investing, and controlling the various trust

estates, the Trustee shall exercise the judgment and care under

the circumstances then prevailing, which men of prudence

discretion and judgment exercise in the management of their own

affairs, not in regard to speculation, but in regard to the

permanent disposition of their funds, considering the probable

income as well as the probable safety of their capital, and, in

addition, the purchasing power of income distribution to

beneficiaries.

estates, the Trustee shall exercise the judgment and care under

the circumstances then prevailing, which men of prudence

discretion and judgment exercise in the management of their own

affairs, not in regard to speculation, but in regard to the

permanent disposition of their funds, considering the probable

income as well as the probable safety of their capital, and, in

addition, the purchasing power of income distribution to

beneficiaries.

(c) My Trustee (as well as my Executor) shall be entitled to

reasonable and adequate and adequate compensation for the

fiduciary services rendered by him.

reasonable and adequate and adequate compensation for the

fiduciary services rendered by him.

(d) My Executor and his successor Executor and his successor

Executor shall have the same rights, privileges, powers and

immunities herein granted to my Trustee wherever appropriate.

Executor shall have the same rights, privileges, powers and

immunities herein granted to my Trustee wherever appropriate.

e) In referring to any fiduciary hereunder, for purposes of

construction, masculine pronouns may include a corporate

fiduciary and neutral pronouns may include an individual

fiduciary.

construction, masculine pronouns may include a corporate

fiduciary and neutral pronouns may include an individual

fiduciary.

Item XIV

Law Against Perpetuities(a) Having in mind the rule against perpetuities, I direct that

(notwithstanding anything contained to the contrary in this last

will and testament) each trust created under this will (except

such trust created under this will (except such trusts as have

heretofore vested in compliance with such rule or law) shall

end, unless sooner terminated under other provisions of this

will, twenty-one (21) years after the death of the last survivor

of such of the beneficiaries hereunder as are living at the time

of my death; and thereupon that the property held in trust shall

be distributed free of all trust to the persons then entitled to

receive the income and/or principal therefrom, in the proportion

in proportion in which they are then entitled to receive such

income.

(b) Notwithstanding anything else contained in this will to the

contrary, I direct that if any distribution under this will

become payable to a person for whom the Trustee is then

administering a trust created hereunder for the benefit of such

person, such distribution shall be made to such trust and not to

the beneficiary outright, and the funds so passing to such trust

shall become a part thereof as corpus and be administered and

distributed to the same extent and purpose as if such funds had

been a part of such a trust at its inception.

contrary, I direct that if any distribution under this will

become payable to a person for whom the Trustee is then

administering a trust created hereunder for the benefit of such

person, such distribution shall be made to such trust and not to

the beneficiary outright, and the funds so passing to such trust

shall become a part thereof as corpus and be administered and

distributed to the same extent and purpose as if such funds had

been a part of such a trust at its inception.

Item XV

Payment of Estate and Inheritance TaxesNotwithstanding the provisions of Item X herein, I authorize my

Executor to use such sums received by my estate after my death

and resulting from my personal services as identified in Item X

as he deem necessary and advisable in order to pay the taxes

referred to in Item I of my said will.

In WITNESS WHEREOF, I, the said ELVIS A. PRESLEY, do hereunto

set my hand and seal in the presence of two (2) competent

witnesses, and in their presence do publish and declare this

instrument to be my Last Will and Testament, this 3 day of

March, 1977.

[Signed by Elvis A. Presley]

ELVIS A. PRESLEY

The foregoing instrument, consisting of this and eleven (11)

preceding typewritten pages, was signed, sealed, published and

declared by ELVIS A.PRESLEY, the Testator, to be his Last Will

and Testament, in our presence, and we, at his request and in

his presence and in the presence of each other, have hereunto

subscribed our names as witnesses, this 3 day of March, 1977, at

Memphis, Tennessee.

[Signed by Ginger Alden]

Ginger Alden residing at 4152 Royal Crest Place

[Signed by Charles F. Hodge]

Charles F. Hodge residing at 3764 Elvis Presley Blvd.

[Signed by Ann Dewey Smith]

Ann Dewey Smith residing at 2237 Court Avenue.

State of Tennessee

County of Shelby

Ginger Alden, Charles F. Hodge, and Ann Dewey Smith, after being

first duly sworn, make oath or affirm that the foregoing Last

Will and Testament, in the sight and presence of us, the

undersigned, who at his request and in his sight and presence,

and in the sight and presence of each other, have subscribed our

names as attesting witnesses on the 3 day of March, 1977, and we

further make oath or affirm that the Testator was of sound mind

and disposing memory and not acting under fraud, menace or undue

influence of any person, and was more than eighteen (18) years

of age; and that each of the attesting witnesses is more than

eighteen (18) years of age.

[Signed by Ginger Alden]

Ginger Alden

[Signed by Charles F. Hodge]

Charles F. Hodge

[Signed by Ann Dewey Smith]

Ann Dewey Smith

Sworn To And Subscribed before me this 3 day of March, 1977.

Drayton Beecker Smith II Notary Public

My commission expires:

August 8, 1979

Admitted to probate and Ordered Recorded August 22, 1977

Joseph W. Evans, Judge

Recorded August 22, 1977

B.J. Dunavant, Clerk

By: Jan Scott, D.C.

***

County of Shelby

Ginger Alden, Charles F. Hodge, and Ann Dewey Smith, after being

first duly sworn, make oath or affirm that the foregoing Last

Will and Testament, in the sight and presence of us, the

undersigned, who at his request and in his sight and presence,

and in the sight and presence of each other, have subscribed our

names as attesting witnesses on the 3 day of March, 1977, and we

further make oath or affirm that the Testator was of sound mind

and disposing memory and not acting under fraud, menace or undue

influence of any person, and was more than eighteen (18) years

of age; and that each of the attesting witnesses is more than

eighteen (18) years of age.

[Signed by Ginger Alden]

Ginger Alden

[Signed by Charles F. Hodge]

Charles F. Hodge

[Signed by Ann Dewey Smith]

Ann Dewey Smith

Sworn To And Subscribed before me this 3 day of March, 1977.

Drayton Beecker Smith II Notary Public

My commission expires:

August 8, 1979

Admitted to probate and Ordered Recorded August 22, 1977

Joseph W. Evans, Judge

Recorded August 22, 1977

B.J. Dunavant, Clerk

By: Jan Scott, D.C.

***

Fonte:Familia Elvis/Elvis,mito e realidade(Mauricio Camargo de Brito)

Nenhum comentário:

Postar um comentário